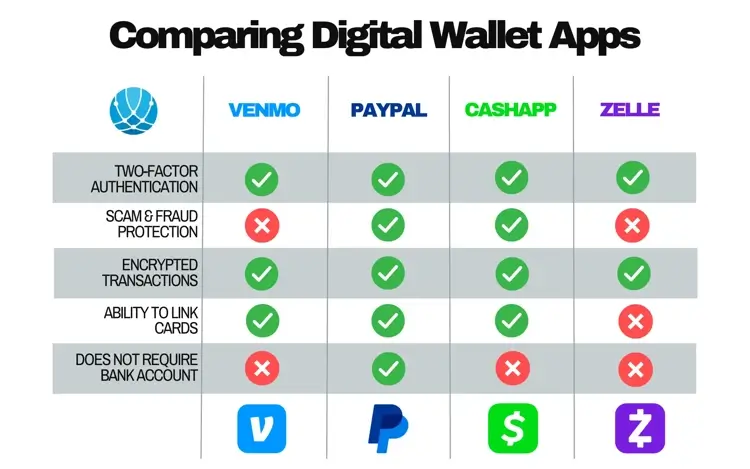

How Safe Are PayPal, Venmo, Zelle, and CashApp?

With the conveniences brought along by technology come growing concerns about users’ personal information safety. Popular banking and payment apps like PayPal, Venmo, Zelle, and CashApp are helpful, but users need be cautious when it comes to their safety. In this article, take a dive into their safety features and learn how to better protect your online banking accounts when using these apps.

What safety features should I look for in a digital wallet app?

Regardless of what digital wallet or payment transfer app you're considering, there are a few safety features you should look for. Check for the following before using an app to hold or exchange funds:

- Two-factor authentication: Make sure the app you use has two-factor authentication enabled. This adds a secure extra step to the login process.

- Payment or transaction notifications: Ideally, you'd be the only one ever making transactions on your account, but enabling payment and transaction notifications will let you be aware immediately should someone else try to use your account to transfer funds.

- Fraud or scam protection policies: Not all digital wallet apps have fraud or scam protection. You want to use an app that allows you to report scams or incidents of fraud and get your money back.

- Wrong-payment protection: Even in completely legitimate transactions, it's possible to accidentally send money to the wrong person. Look for apps that identify user accounts with unique, individualized items - like a QR code - rather than a username that can be easily mixed up.

It's also important to check the data collection policies for each app you consider. Make sure that you're comfortable with the amount of data collected, and furthermore, check that the data they do collect is appropriately managed. All of these things improve your safety on Venmo, PayPal, or any other digital wallet app.

Is PayPal safe? Assessing PayPal safety

PayPal is a popular means of money exchange among businesses and buyers. PayPal does not require users to input their bank account or credit card information, nor does it display users’ information to other platform users, which improves users' safety.

For buyers, PayPal secures transactions through encryption technology, protecting your PayPal account against hackers. If a scam does take place, PayPal will provide a full refund if the ordered product arrives damaged or never shows. However, buyers must open a dispute within 180 days of the initial payment to receive the refund.

As a PayPal safety feature, the application provides seller protection as well; sellers are to report suspicious activity to PayPal where they can confirm a fraudulent transaction and prevent further fraud.

However, the setup and login process is not as protected as it could be; it only requires a username and password to create an account. Therefore, it's crucial that users choose a strong password and enable two-factor authentication. Both of these things will improve the security of your PayPal account.

PayPal offers 24/7 fraud monitoring services, so someone is always looking out for users’ safety. Ultimately, yes, PayPal is a safe app to use.

Is Venmo safe? Assessing Venmo safety

Venmo is another online money-transferring app that allows users to send and receive payment requests peer to peer. Like social media, Venmo requires users to send and approve follow requests from other Venmo account holders, which is a good safety step. Users receive a payment request, and the recipient will send money through the app like a direct messaging feature.

Venmo differs from PayPal because it requires a bank account connection to complete transactions. Additionally, Venmo does not offer a refund policy in the case of scams as PayPal does. Both of these things make Venmo safety slightly more difficult. It makes users more vulnerable to scams or monetary losses.

Venmo and PayPal are similar in their user security. Both apps utilize encryption technology to protect banking information, meaning no one should be able to access a user’s credit or debit card information except for the account holder themselves. Venmo also offers a PIN code setting to serve as an additional safety measure.

Generally, Venmo users can rest assured that yes, Venmo is a safe way to exchange money.

Is Zelle safe? Assessing Zelle safety

Zelle is a safe and secure app designed by banks with data encryption protection on personal information. Zelle also uses authentication and monitoring features when making payments for improved safety.

Like Venmo, the Zelle app allows users to send money to other Zelle account holders without worrying about safety. This is because the transfer reveals no sensitive details. Zelle stresses the importance of sending money only to accounts you recognize and can certify as trustworthy to stop attempted scams before they happen.

However, Zelle does not offer any sort of fraud protection on authorized payments. This means if you approve the payment and it ends up being a scam, a refund is not possible through Zelle. Because fraud protection is not likely, it is important to guarantee you’re sending money to a reliable recipient.

Users can't link their Zelle account to a credit or debit card. This measure improves Zelle safety and makes theft less likely. However, it also makes transferring money to your bank account rather difficult.

Unfortunately, Zelle has been known to see a significant amount of fraud, more so than PayPal and Venmo. Zelle is safe to use with friends or family whose accounts you trust, but it is not safe to use for any goods or services transaction or transactions with strangers.

Is CashApp safe? Assessing CashApp safety

Just like the safety in the other three applications, CashApp payments and other user information are protected by encryption and fraud detection technology to safeguard CashApp account holders’ information.

To use this app, users must link their CashApp account to their bank account. This has the potential to make users vulnerable, since their account is linked directly to their bank. However, the app sends new users a one-time-use login code to verify their identity and has a security lock feature as another level of protection.

To avoid fraud, be aware of where CashApp emails come from. CashApp emails only come from @square.com, @squareup.com, and @cash.app.

Trustworthy links in these emails will contain square.com, cash.me or cash.app.

Additionally, CashApp users will never be asked to provide a sign-in code, PIN or Social Security number (SNN). As a safety measure, CashApp never requires users to send a payment to make a purchase or download another app. If an email requests this information or actions, report it as potential fraud.

Like Venmo, CashApp provides fraud coverage. If you report a scam or fraudulent payment, as a CashApp safety feature, they can cancel the transaction and refund your money. Though CashApp has its flaws, ultimately, yes, CashApp is a secure app to use for monetary transactions.

General safety tips for Venmo and other digital wallet apps

Even though these digital wallet apps are secure, users need to make sure that they're taking additional safety measures to protect their money and information. Make sure to follow these safety tips when using PayPal, CashApp, Venmo, Zelle, or any other banking app:

- Only link credit cards to your account whenever possible. Apps like PayPal and Venmo allow you to link your debit card to your account in order to make payments and transfer money to your bank.

However, this puts you at a serious risk should your app account be hacked. Link a credit card instead. You'll have a better chance at canceling fraudulent payments through your credit card company if you do get hacked. - Register with a secure password. Make sure you utilize a strong password when creating accounts for online banking or digital wallet applications.

- Verify the identity of users you complete transactions with. Only send money to people you know or people whose accounts you can verify before the exchange.

- Monitor your accounts. Check in on your apps and your bank accounts often to ensure there's no suspicious activity.

Almost every online banking app is safe if users take the proper precautions. Apps developers have gone to great technological lengths to ensure the safety of their account holder’s financial information. While no online banking app is completely immune to fraud, they are largely safe to use, convenient to have, and, most importantly, very secure.